For Asset Managers and Other Financial Institutions

Manage climate risk — Identify non-consensus transition risks. Assess transition risk across scenarios. Develop financial products (e.g., indices and annuities).

Meet regulatory requirements — Including scenario modeling and stress-testing requirements for TCFD, EU SFDR Article 8, and US Federal Reserve CSA.

Identify opportunities in the climate transition — Support recommendations and validate assumptions. Build and manage climate-aware portfolios, while retaining diversification.

The Power of Hybrid

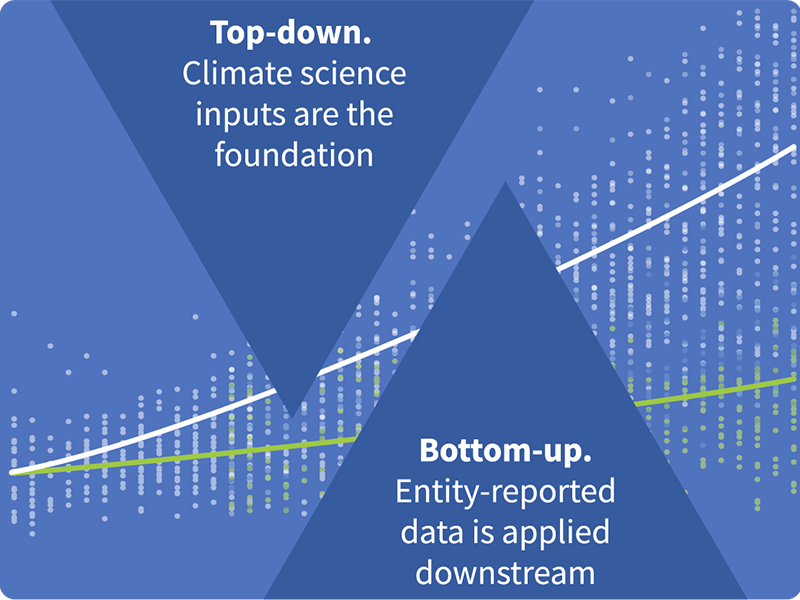

Entelligent’s disciplined hybrid approach provides forward-looking predictive power and backward / forward comparability — while maintaining financial materiality and enabling carbon accounting. Download the Smart Climate solution brief.

Read more

Next Steps

Read our deep-dive T-Risk methodology paper to find out what makes Entelligent’s model different.

Download

”Probably the best way to measure transition risk that I have ever seen.

— Asset manager | Top 5 Nordics-based investment bank