Integrity Research Associates, LLC, has published a new report on Entelligent’s release of Smart Climate 2.0. The report was prepared by Integrity Research principal Michael W. Mayhew. The report focuses in particular on Entelligent’s addition of two new carbon data offerings — Smart Climate Carbon Accounting and Smart Climate Carbon Sensitivity.

The report states:

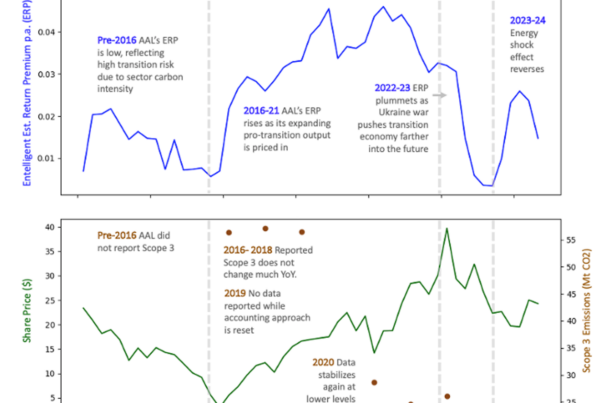

Entelligent’s patented Smart Climate methodology is disciplined in emphasizing top-down climate data as its primary input. Despite this fact, carbon accounting is an explicit requirement of the Taskforce on Climate-Related Financial Disclosures (TCFD) and most other climate risk frameworks. As a result, Entelligent has developed two carbon data products, which deliver a high standard of quality relative to comparable offerings.

The report also reviews the details of each carbon product:

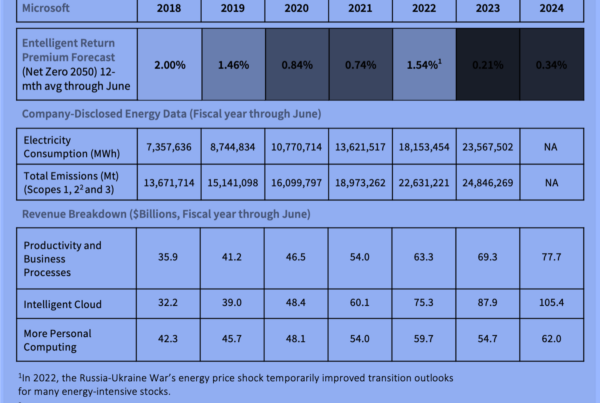

Smart Climate Carbon Accounting: This is a direct feed of company-reported carbon data, necessary to report security-level Scope 1, 2 and 3 greenhouse gas emissions, a requirement of many climate risk compliance frameworks, including TCFD.

Smart Climate Carbon Sensitivity: This is a scoring model developed by Entelligent to bring greater financial relevance to carbon data. This score comprises two unique carbon KPI calculations: Breakeven Carbon Price reflects a company’s ability to pay a price on carbon while maintaining positive net income. Carbon Per Share (CPS) is the number of CO2-equivalent tons “included” in each share of equity.

Entelligent’s two new carbon accounting products include both company reported and estimated “greenhouse gas” (GHG) data for 9,000 global listed equities back to 2019. These estimates are calculated based on market capitalization. If total GHG is not provided, Scope 3 is not estimated. These products provide annual data, with monthly updates based on entity reporting dates.

The complete report can be found here.

Founded in 2003, Integrity Research is an advisory firm that analyzes the global investment research industry. The firm serves hedge funds and asset managers with expert counsel on the external research sources they use to enhance their investment returns. Integrity monitors key research industry developments, including ways to mitigate research compliance risks.

The full article and Entelligent company profile are available here.