As Warren Buffett said, “When the tide goes out … .”

For as long as ESG investing has existed, there has been a debate about whether its performance is the result of inflows or of alpha. Most analysts have agreed it’s been driven mostly by inflows – implying that ESG performance is not sustainable.

This was borne out when, two years ago, amid the energy shock triggered by the Russia-Ukraine war, ESG fund performance took a beating. And now, the FT reports that outflows are accelerating. (See article ”Investors pull cash from ESG funds as performance lags: Sustainability-focused equity funds suffer net $40bn of outflows in 2024, the first sustained exodus,” Financial Times, June 5, 2024)

According to the FT: ”The outflows mark a significant reversal for a sector that investors have flocked to in recent years, attracted by the claim that such funds could help change the world for the better while also making as much — or even more — money as traditional stock portfolios.”

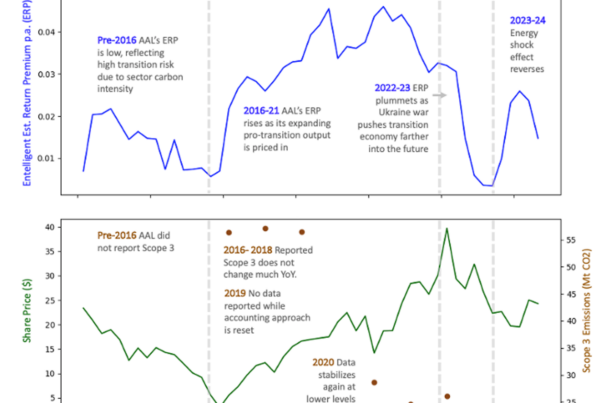

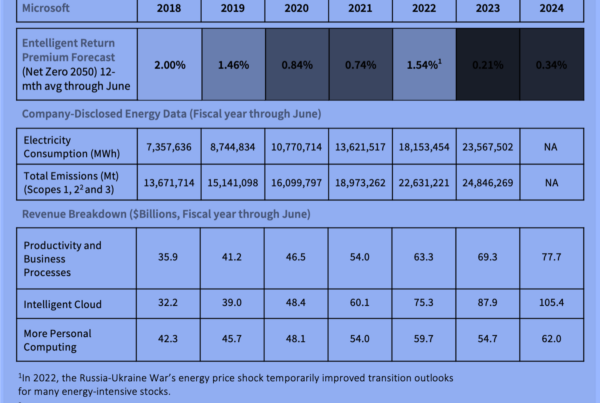

At Entelligent, we believe that to really capture the opportunity presented by the energy transition, an approach anchored in financial materiality and energy forecasting is required.

Entelligent’s energy transition metrics are additive to performance. They measure the impact of energy pricing and demand changes on future investment performance. Entelligent drives both performance and carbon reduction by enabling more accurate discernment among energy transition leaders and laggards — regardless of industry sector.