Most climate-aware investors likely know that metals and minerals play a critical role in the transition to a low-carbon future. Anglo-American, for example, has long been recognized as a provider of the copper, platinum, palladium, nickel, and diamonds needed to produce renewables technologies. But when it comes to assessing such companies’ transition readiness, their reported data makes it hard to find solid ground to stand on.

AAL has reported reductions in Scope 1 and 2 data over the years, driven largely by shifts in how it sources energy for its extraction processes. The company’s full divestment from thermal coal in 2021 played a significant role in these reductions.

Scope 3 emissions, however, which account for 88-94% of the company’s total reported GHG from 2016 to 2023, present a more challenging narrative. The company’s Scope 3, covering downstream use of its products, virtually halved between 2018 and 2021, dropping from 226 million metric tons (MT) to 115 MT. The company attributed the reduction largely to changes in reporting methodology and, again, to divestment from thermal coal.

But AAL’s seemingly positive transition story has been overshadowed by criticism for its emissions reporting irregularities. Not just methodology changes, but gaps and lags: It generally reports on a 12-month lagging basis. Its 2020 Scope 3 data didn’t come out until October 2021. It did not provide Scope 3 data for 2019. And so on… All of this severely cramps the, er, style of investors trying to assess the company’s risk in something closer to real time.

By the time the markets were aware of Anglo’s halved Scope 3 emissions in late 2021, the energy environment had changed dramatically – with inflation and the Russian-Ukraine war’s energy price shock taking hold – making many low-transition risk companies less advantageous investments in the near term.

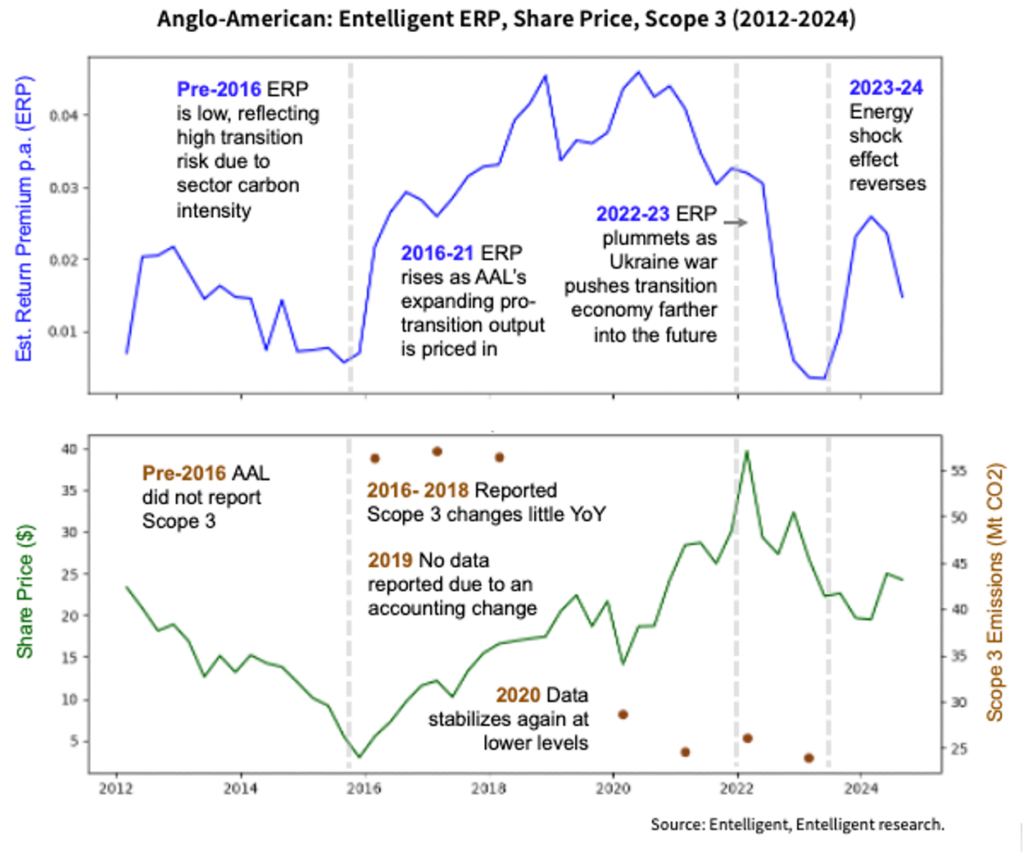

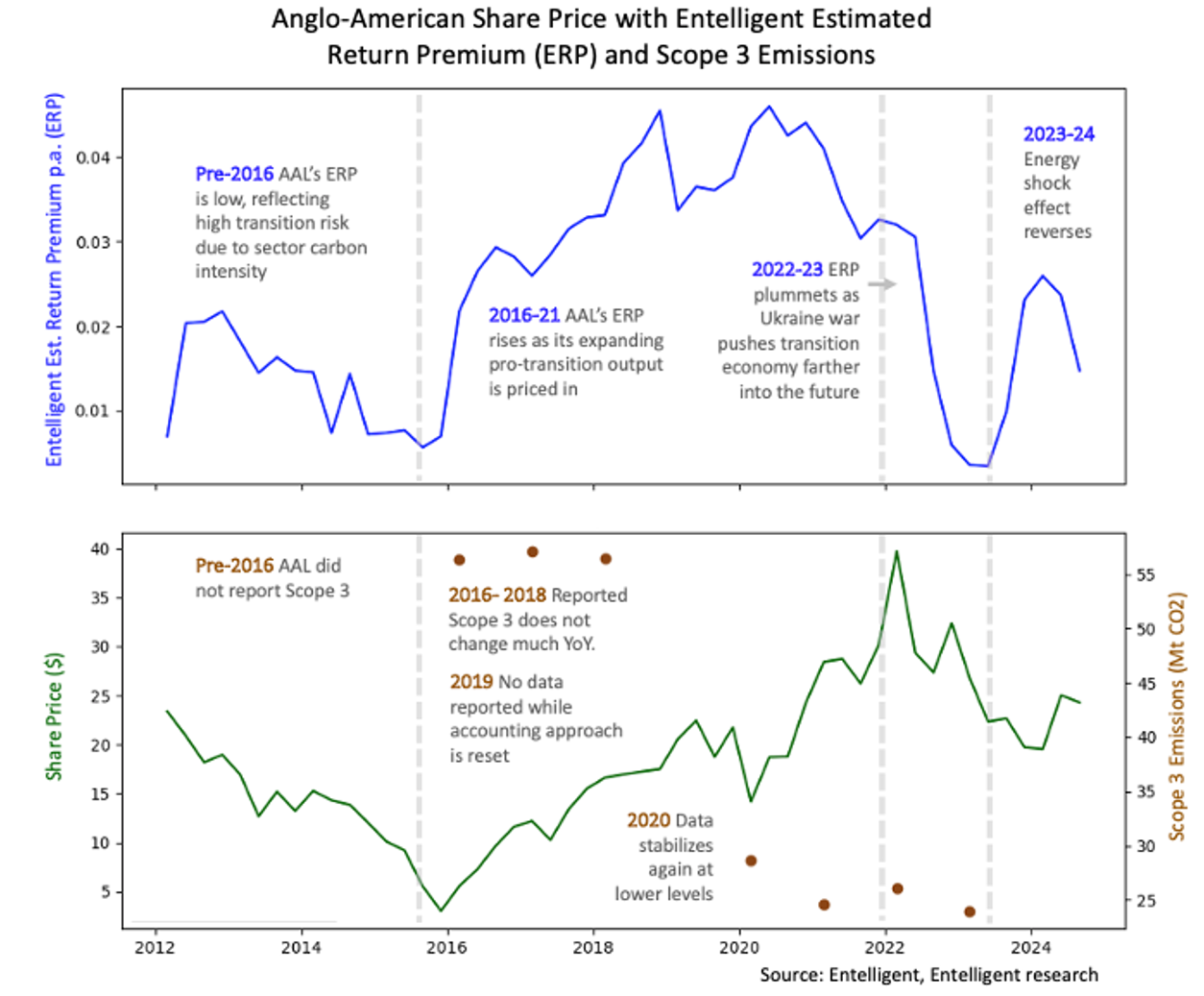

In contrast, Entelligent’s unified transition risk data tracked every heartbeat of Anglo’s evolving risk profile – and remained fully untainted by its irregular emissions reporting. Measured using Entelligent’s T-Risk methodology, Anglo’s improving estimated return premium (ERP) after 2016 reflected its strategic position as a supplier of essential materials for the green economy – rising from a low of 0.57% p.a. in 2016 to a high of 4.6% p.a. by 2020.

That trajectory took a sharp turn during the 2021 energy price shock, when global disruptions caused both energy and raw material costs to surge – leading Anglo’s ERP to deteriorate faster than the broader market because of its heavy exposure to these transition-critical sectors. It found a new low at 0.35% p.a. in 2023, before settling back to 2.59% p.a. – all of this untainted by reporting gaps.