The FT has been doing great work on climate change’s impact on business and investing. Its latest report focuses on BlackRock’s support for ESG-related shareholder proposals, including climate – which has fallen to a new low. The firm accepted only 20 of 493 environmental and social proposals offered by shareholders at its annual meeting (about 4%).

The team at Entelligent has not been surprised to see BlackRock’s continuing retreat from ESG. In fact, we understand exactly why they did it.

BlackRock isn’t stepping back from ESG because its investors and clients don’t care but because the ESG proposals so often reflect externalities that don’t have direct financial impact on the investments.

The FT quoted BlackRock’s global head of investment stewardship Joud Abdel Majeid, who described this year’s batch of shareholder proposals as “overly prescriptive, lacking economic merit or asking companies to address material risks they are already managing.”

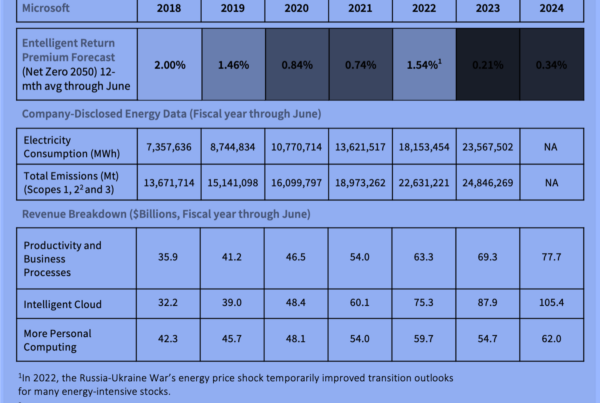

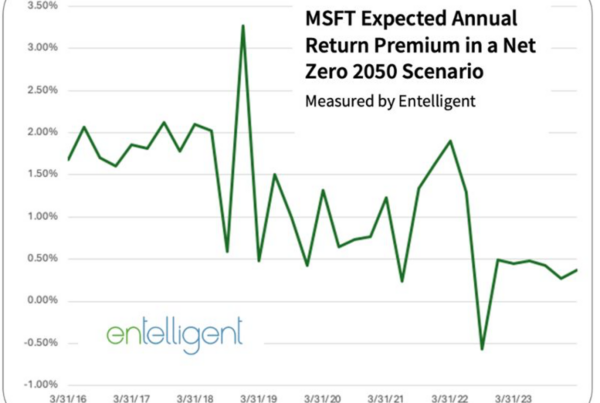

Qualitative measures can be ambiguous, but when metrics are quantified and tied to financial materiality, they command attention and drive action. At Entelligent, we know that transition risk data CAN provide quantitative financial materiality to more accurately measure economic risk to investors and corporates. In fact, providing that insight and foresight is our mission.

As an asset manager or owner, do you feel like you have the right tools and metrics to manage risk?

(Pooja Khosla, Ph.D., is Chief Executive Officer of Entelligent. Contact her here.)