Release Announcement | Smart Climate Carbon Accounting and Smart Climate Carbon Sensitivity

October 5, 2023 | Boulder, Colorado — Entelligent today announced the general release of Smart Climate Carbon Accounting and Smart Climate Carbon Sensitivity, new products that augment the company’s Smart Climate data and analytic suite for asset managers and banks looking to manage climate risk and meet compliance requirements.

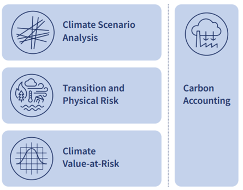

Entelligent’s carbon data products, which enable tracking and analysis of company-reported greenhouse gas emissions, are part of the newly released Smart Climate 2.0, which also includes the flagship T-Risk transition and physical risk score and the soon-to-be-released Smart Climate Value-at-Risk model and data service.

Smart Climate 2.0 is designed for asset managers and financial institutions seeking a consistent, replicable and accurate approach to measuring, managing and disclosing climate risk. It supports the Task Force on Climate-related Financial Disclosure (TCFD) framework, which forms the basis of most regulatory standards and increasingly is a best-practice model for institutions.

Entelligent’s Smart Climate 2.0 – Expanded Capability Set

While Entelligent’s patented Smart Climate methodology is disciplined in emphasizing top-down climate data as its primary input, carbon accounting is an explicit requirement of TCFD and most climate risk frameworks. As a result, Entelligent has developed two carbon data products, which deliver a high standard of quality relative to comparable offerings.

- Smart Climate Carbon Accounting is a direct feed of company-reported carbon data, necessary to report security-level Scope 1, 2 and 3 greenhouse gas emissions, a requirement of many climate risk compliance frameworks, including TCFD.

- Smart Climate Carbon Sensitivity is a scoring model developed by Entelligent to bring greater financial relevance to carbon data. This score comprises two unique carbon KPI calculations: Breakeven Carbon Price reflects a company’s ability to pay a price on carbon while maintaining positive net income. Carbon Per Share (CPS) is the number of CO2-equivalent tons “included” in each share of equity.

Benefits

- Flexible methodology: Enables addition of private company coverage, as well as additional historical data upon request.

- Broad and deep coverage: Includes core GHG data for 9,000 global listed equities, including Scope 1, 2 and 3 emissions.

- Timeliness: Low latency versus competitors (relative to time of entity reporting).

- Industry standard: Meets Partnership for Carbon Accounting Financials (PCAF) standards. Supports TCFD compliance.

Specifications

- Data Partner: Entelligent’s carbon accounting products rely on data provided by IdealRatings® in collaboration with Entelligent’s distribution partner FactSet.® Entelligent’s analytic suite, including flagship metrics E-Score and T-Risk, is available on the FactSet Portfolio Analysis workstation. Entelligent has also adopted IdealRatings data for Carbon-Adjusted T-Risk calculation.

- History: 2019

- Methodology: Includes reported and estimated GHG data. Estimates are calculated based on market capitalization. (Where total GHG is not provided, Scope 3 is not estimated).

- Frequency: Annual data, with monthly updates based on entity reporting dates.

- Coverage: Core GHG coverage of 9,000 global listed equities (to increase to 15,000). Deep emerging markets coverage backed by strong international market expertise.

For more information, contact:

Hadrien Moulinier

Chief Revenue Officer

Entelligent

hmoulinier@entelligent.com