INTRODUCTION

On the eve of a Supreme Court decision that sharply limited the EPA’s ability to curb greenhouse gases, 23 leaders of global companies, active in climate investment and risk management, met virtually to share practices and experiences. (Participants represented organizations from across the full climate investment value chain, as shown in the Appendix.) The meeting’s agenda, developed through individual-member interviews, spanned regulation, communication and implementation. Participants discussed the growing challenges of implementing and marketing climate-aware, and more broadly ESG-oriented, investment products in a fast-changing market.

DEVELOPMENTS TO WATCH

The conversation highlighted critical marketplace issues that may lead climate investment product providers to tap the brakes just as innovation has shifted into high gear.

These include:

1) Who will fill the regulatory vacuum left by the Scotus decision? Will the SEC ultimately force more standardization and clarity?

2) Will Congress grant the EPA any emission standard-setting powers? Will we see a reduction in financial products labeled as “ESG”?

3) Who will take the lead in educating regulators and the investing public?

EXCHANGE HIGHLIGHTS

Key Takeaway

Regulatory growing pains are fueling skepticism: Will things get worse before they get better?

Participants discussed their recent SEC audit experiences, describing increased scrutiny of ESG, while also voicing concerns about the regulatory process and its potential adverse impacts. While those who underwent ESG audits said the process was not onerous, some expected scrutiny to intensify over time, especially of ESG-specialist firms. As members considered regulatory agencies across jurisdictions, the consensus was that the industry is in a transition phase, with all players confronting a steep learning curve.

- “ I don’t know how long that transition period takes or what’s the tipping point at which you switch from box-ticking to substantive information that influences decision-making.”

- “ It’s the first time I’ve seen a regulatorily-mandated index methodology…. [It] has become a catalyst for fund managers and investors but it’s only one path and there are many to net zero…. The easy work is gonna get done — and some of the big gains can be made quickly — but then everything gets a lot harder.”

- “ [It’s] getting a little bit ridiculous because [auditors] are not specialists or sector or industry analysts. They might not know the companies [in an index] that well… So, if you are doing an ESG index that has hundreds of stocks, that approach doesn’t work.”

- “ Right now, the applications and solutions are more qualitative and harder to justify. But as we become more transparent, more measurable, and more quantified to show results, the response to audits will become more powerful.”

- “ Responding to SEC questions is difficult, I think, for advisory firms but a much, much easier lift for asset management firms. For advisors who are creating portfolios of third-party products, where you have different approaches, it also becomes very difficult to reconcile all those approaches.”

Key Takeaway

With informal information-sharing playing an outsized role in compliance, a lack of standards and structure is a universal pain point.

Participants had mixed feelings about communication and knowledge-sharing. Many emphasized the value of informal communications and information-sharing throughout the climate-investing supply chain. Others, directly and indirectly, described a need for more formal education and standard-setting — and a belief further education on climate investing could help combat anti-ESG attitudes that have emerged. While most agreed more education is needed to level the field, many wondered whether that was really their responsibility. Looking at the issue through a U.S. SIF (Specialized Investment Fund) lens, executives agreed their investment firms must be more careful about making specific ESG investment claims as the space continues to shift.

- “ Anecdotally I’ve had, in the last month, seven or eight groups reach out to me because they are going through a similar audit. …To the extent that I can help any of you, provide the detail, whether it’s prospectus language that we have [developed, please let me know].”

- “ There’s a learning curve. In some countries, they really don’t know what ESG

is or what climate investment is. They actually would benefit from getting education, from firms like the data firms in particular, because a lot of the index methodology goes back to the underlying data sets.” - “ It’s about the messaging. The bigger we’ve gotten, the louder we’ve gotten, and the more issues have come up in terms of backlash and all of that.”

- “ Whose responsibility is it to educate the public? … We have to educate our investors and the public in general. But who does that? And what are the guidelines?”

Key Takeaway

Effective implementation of climate investment strategies has grown more challenging, leaving many to seek middle- ground solutions.

In the wake of SEC actions against Goldman Sachs and BNY Mellon for their ESG labelling,

the industry’s uncertainty is playing out in varying degrees of action and inaction. Regulatory ambiguity has led some to question investment choices. Others described playing it safe by avoiding the “ESG” label altogether. (Indeed, one cited a study that linked mislabeled ESG funds to less favorable outcomes.) While many argued that current ESG compliance regimes have little to do with an investment strategy’s actual climate impact, others emphasized the importance of adopting an impact perspective nonetheless — understanding a portfolio’s intent and philosophy and communicating that robustly, including to regulators. Finally, there was a keen awareness within the group of the gap between those with deep experience in ESG investing and those with far less.

- “ What we’re really interested in is how do we develop robust practice? So, we’re not scratching our heads around [whether something is] an appropriate ESG investment or not — is this an appropriate way of assessing climate risk or not?— so that there’s a little bit more certainty in the marketplace about what people are doing and whether they’re doing it in an accepted, correct manner.”

- It is very important to look into the future but also to back test this future in order to see whether the impact is philosophical or if it is a verified impact.”

- “ In some cases, even experienced people aren’t as clear as they might be about what’s really the impact of the investment. And we find that even some very sophisticated institutional ESG asset owners don’t really have a clear, crisp, succinct description about what the actual impacts are. … [They need to] be able to bring more technical expertise to that process and … to the sales process.”

- “ We shouldn’t have firms arguing with the SEC. Let’s get people to provide and companies to provide the information and we can let the market interpret it. … But standardizing reporting can give us a better way to price in risks. It gives us a better way to, to understand where companies are on their continuum towards energy transition and it’ll allow us, which we always have done as a marketplace to, you know, to reward companies by profits when they produce something that’s a benefit.”

APPENDIX

The Climate Investing Value Chain

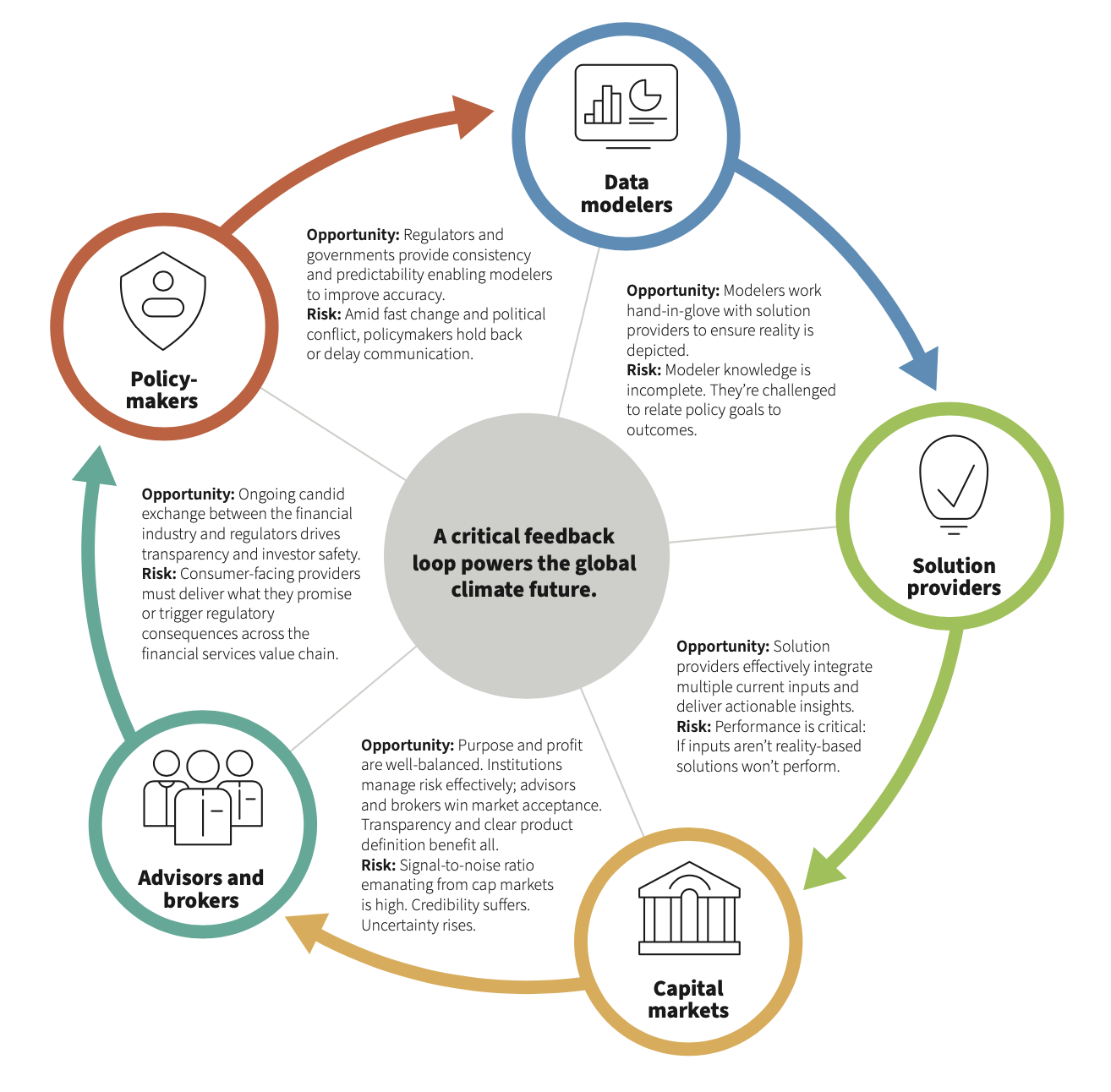

Constituencies participating in the Entelligent Climate Risk Investment Exchange