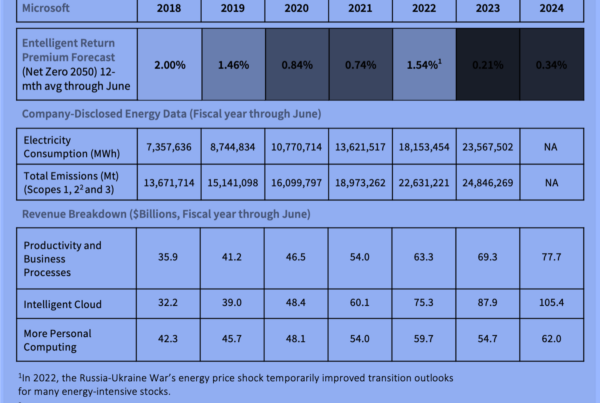

Everyone’s talking about the FT article last week that detailed Big Tech’s push for carbon credit rule changes that could obscure their true emissions. Companies like Microsoft, Meta, Amazon, and Google – generally considered “green” – are poised to become massive energy consumers, thanks to growth in their AI businesses. Between 2020-2023, Microsoft’s emissions jumped 30%, and Google’s nearly 50%, largely due to new data centers.

But here’s the thing: Even if the rule changes are not adopted, Big Tech stocks (like most others) will continue to carry meaningful climate and energy transition risk that most investors can’t measure – because carbon-based data only tells part of the story.

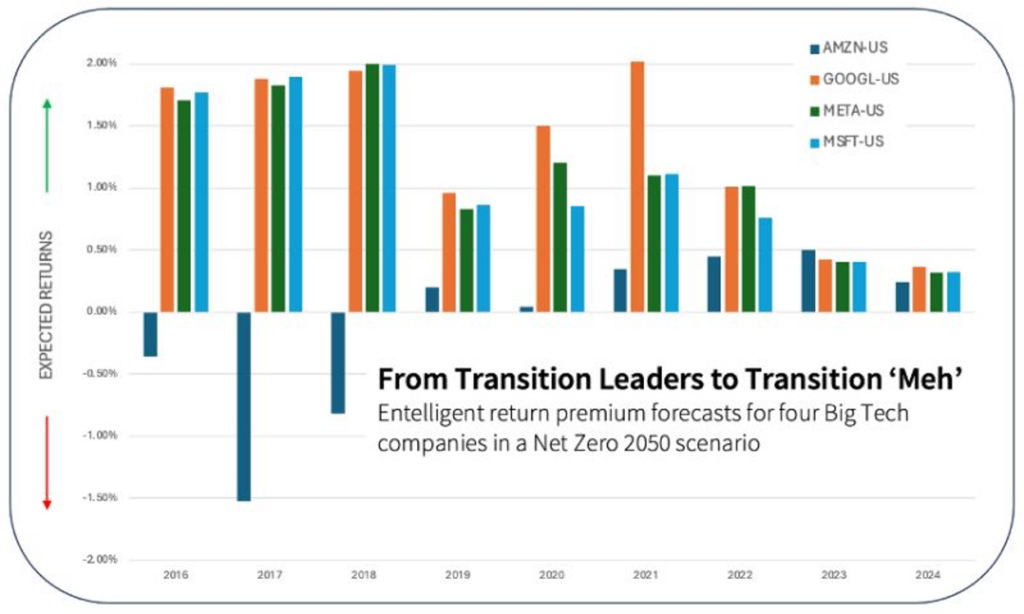

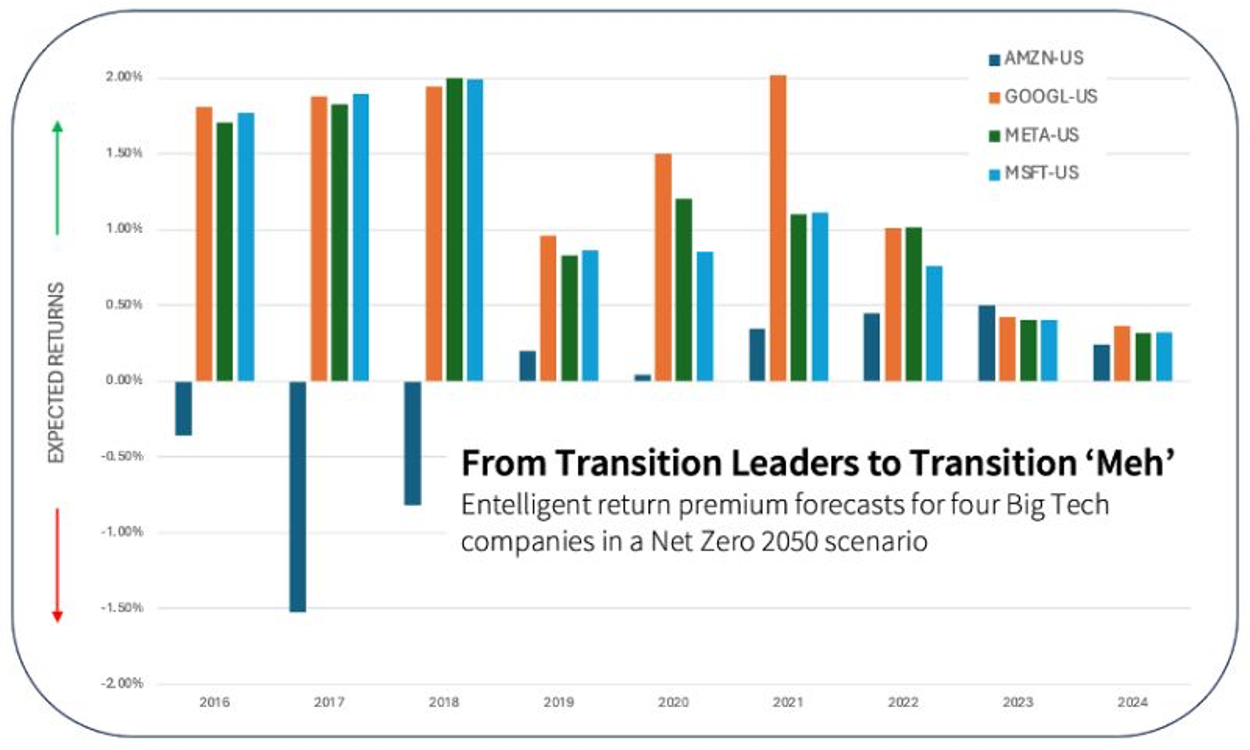

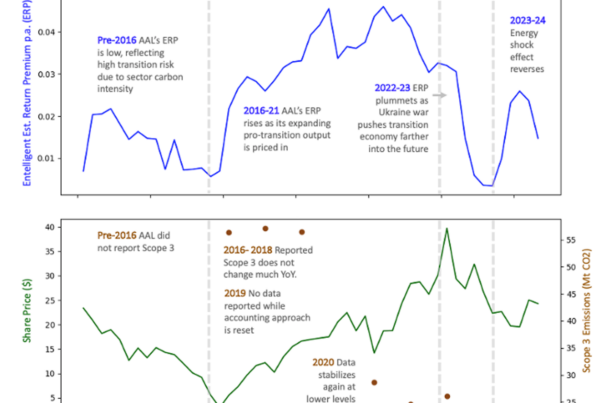

Entelligent’s unified transition risk methodology avoids carbon data entirely, using energy and climate scenario models to forecast performance at the individual security level. Investors and risk managers using our data would have been able to track Big Tech’s risk shift as it was emerging. As shown, from 2016-18, MSFT, META, and GOOGL were forecast to outperform in the transition, but they’ve deteriorated since.

(Hadrien Mouliner is the Chief Revenue Officer of Entelligent. You can contact him here.)