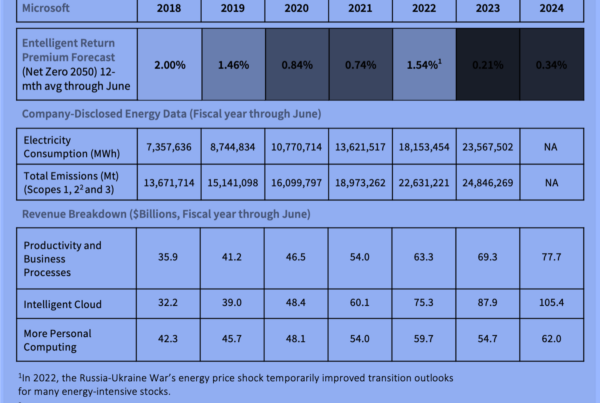

In its latest annual sustainability report, published June 12, Microsoft revealed that its carbon emissions had increased by nearly 30% since 2020, “primarily due to the construction of data centers.”

This came as a surprise to most investors, according to CNBC (https://cnb.cx/3RBCIRH) – but not to users of Entelligent’s data.

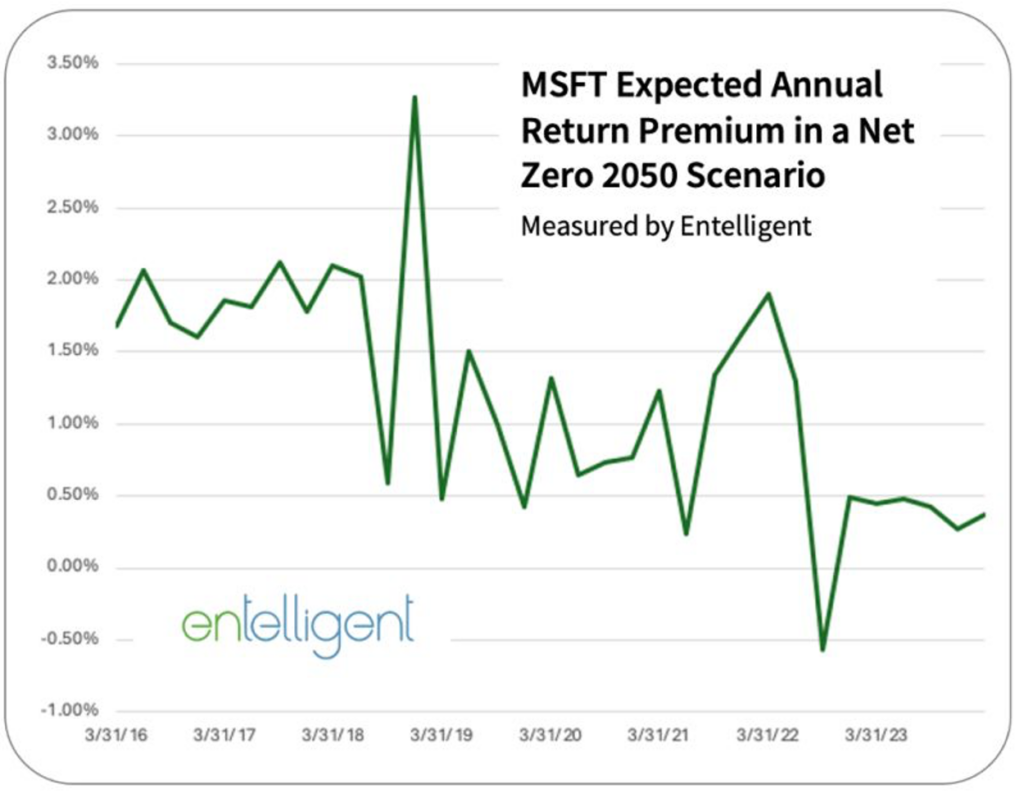

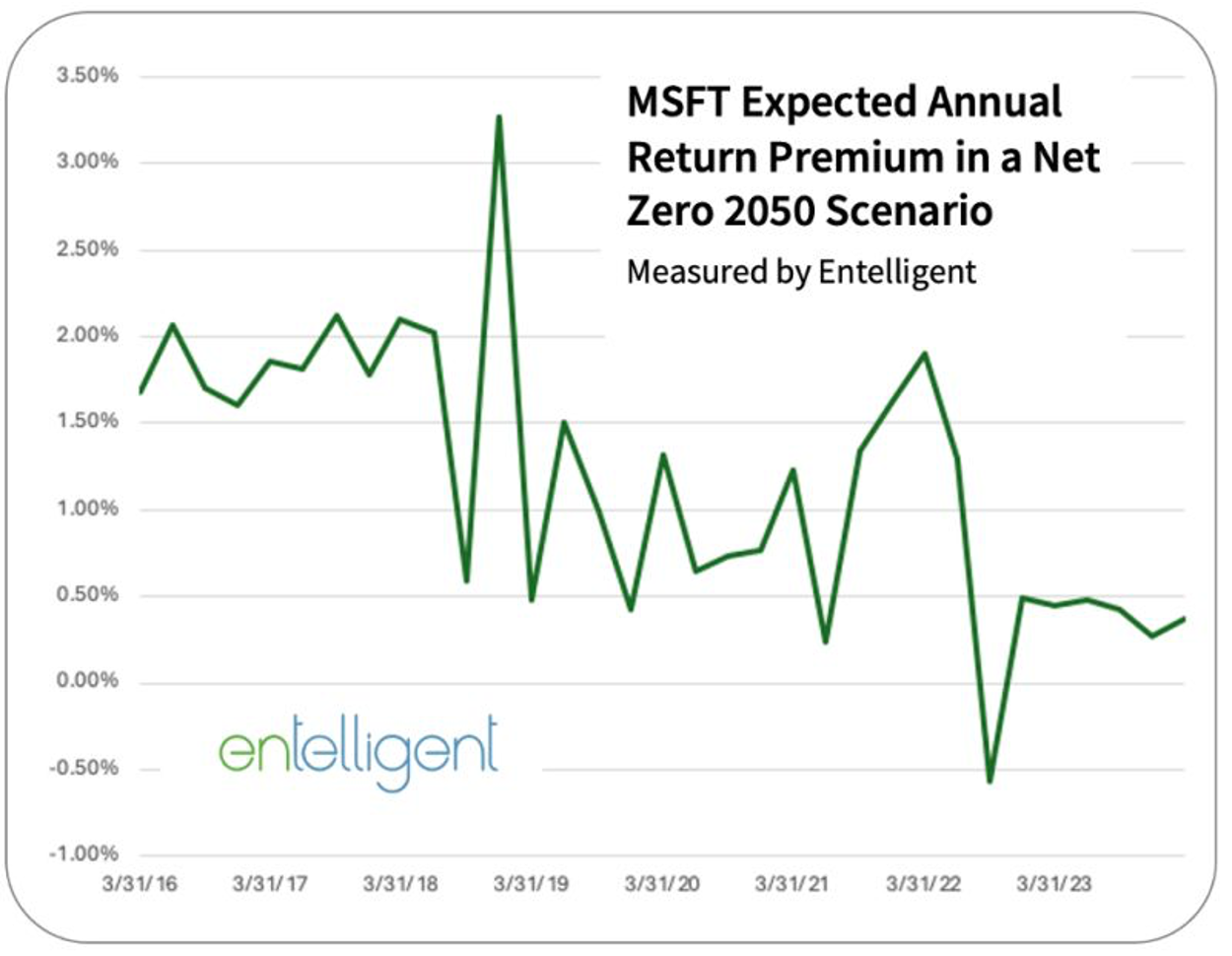

As shown in the chart, Entelligent clients would have been able to see – in advance – a steady decine since 2020 in Microsoft’s expected return premium in a NetZero 2050 scenario.

Entelligent’s proprietary data solutions are purpose-built to uncover forward-looking performance insights exactly like these.

Our data analytics enable investors to measure and manage transition risk (and transition opportunities), down to the individual security level. Leading financial organizations rely on Entelligent because our methodology is entirely empirical – not designed to meet the objectives of an external value system such as “green” investing or ESG. Unlike others, Entelligent delivers financially relevant metrics – risk premia, impact to P&L, etc. – that users can readily integrate into their workflows to forecast performance in various transition scenarios.

What other companies in your portfolio carry unexpected climate and energy transition risk? Given massive recent growth in AI processing, and ongoing fierce competition among operators of server farms, it’s a question asset managers might want to ask…