By Hadrien Moulinier, with Maximillian Nelte and Alice Luo

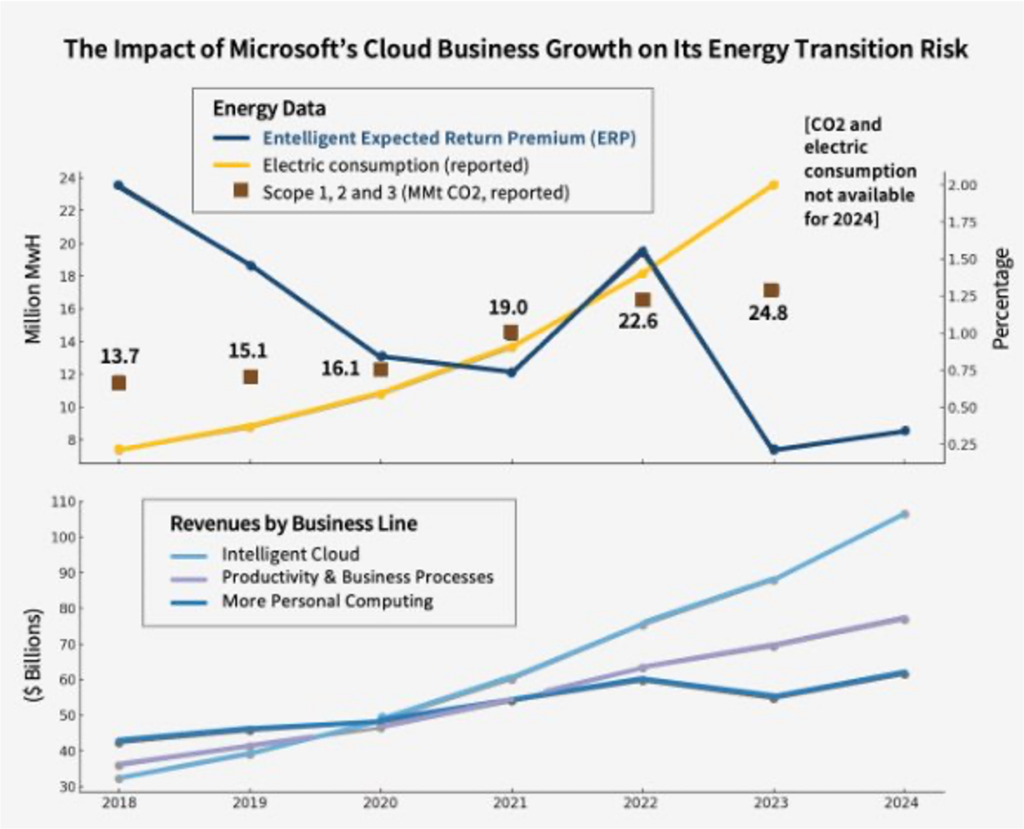

A while back, we posted about the increasing climate and energy transition risk faced by Big Tech firms, mostly due to explosive growth in cloud computing and the dramatic ramp-up in generative AI. Companies like Microsoft, Meta, Google – generally considered “green” – were fast becoming massive energy consumers.

Most ESG data providers (unnamed in this post) missed – and continue to miss – this signal, leaving their users unaware that Big Tech’s transition risk exposure had undergone a reversal:

- Unnamed ESG data provider No. 1 gives MSFT an Environmental rating of 1.5 – high marks indeed given that scores from 0 to 10 have “negligible” risk.

- Unnamed ESG data provider No. 2 similarly gives a high Environmental rating to Microsoft, the best of its E, S, and G components.

- Unnamed ESG data provider No. 3 rates Microsoft as “in line with” the Paris scenario (Net Zero 2050) – the key driver of its “Very High” overall ESG rating.

In producing their scores, these providers rely on company-reported emissions data and reduction commitments. As a result, in Microsoft’s case, they ignore the 2X growth in energy consumption the company experienced (in just four years!).

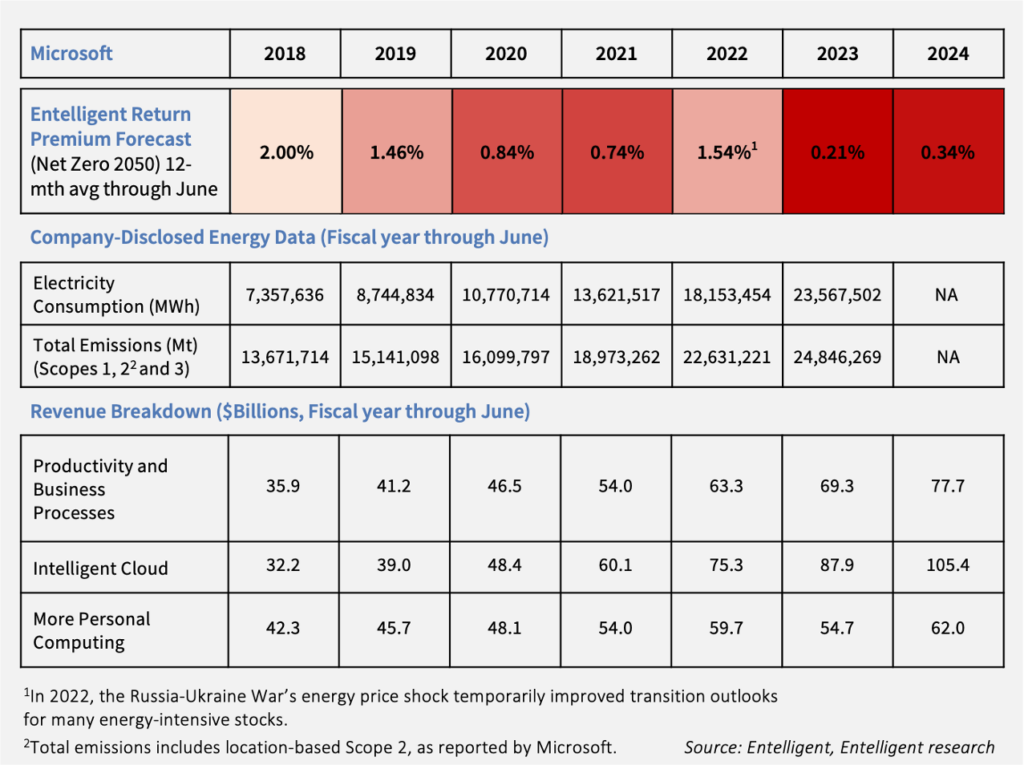

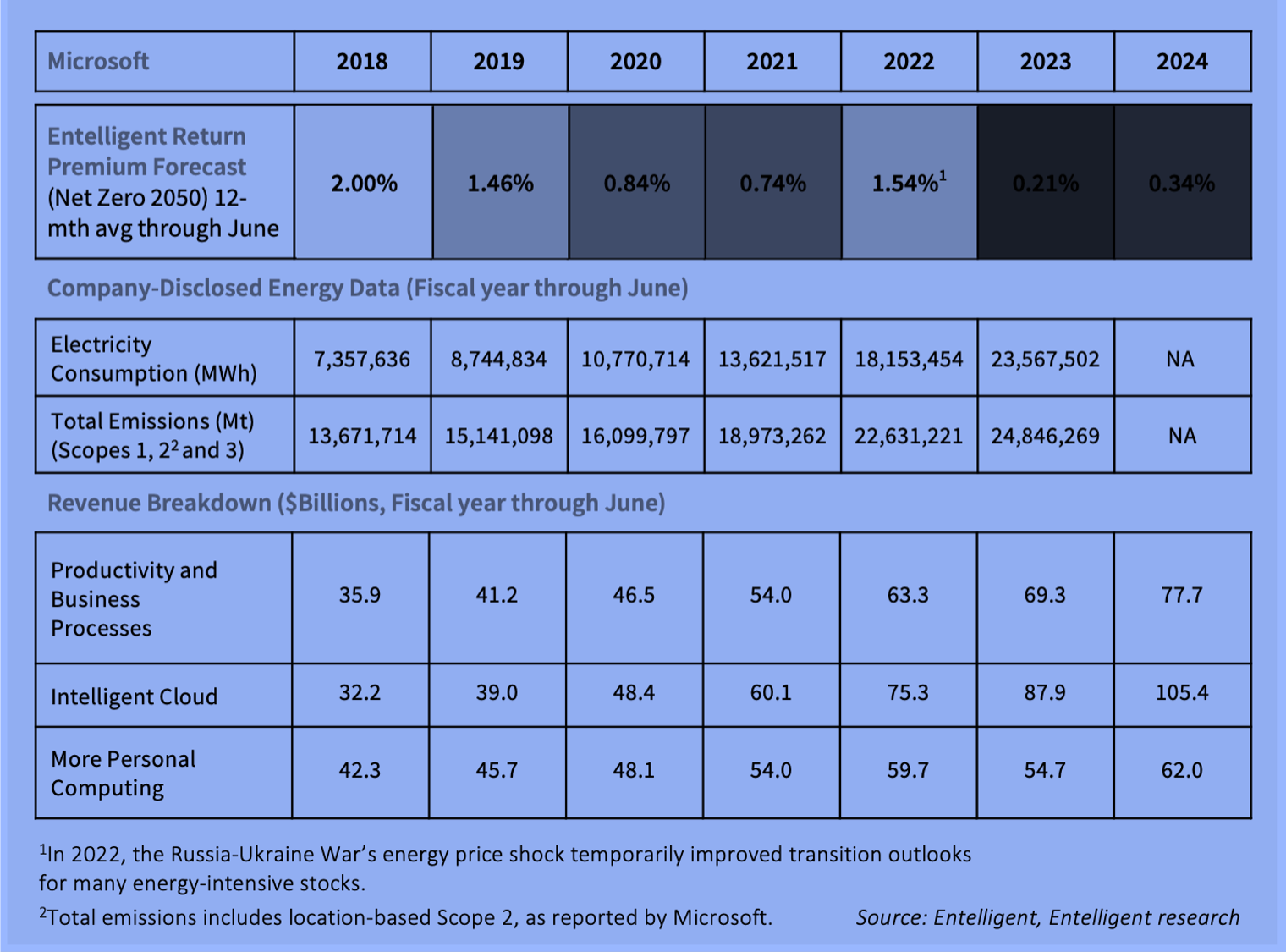

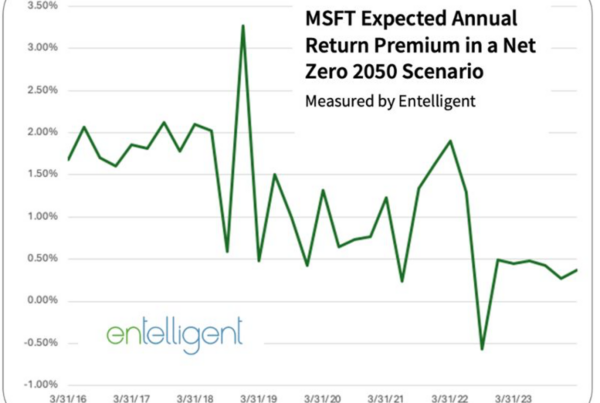

In contrast, as the table below shows, Entelligent’s unified transition risk model captured this shift, which the markets had started pricing in as early as 2019.

The bottom line: Carbon data will continue to play an important role in risk assessment. But those looking for actual transition risk measurement – predictive insight into the future performance of stocks and portfolios in defined climate scenarios – might consider bringing Entelligent into the mix.

(Hadrien is Entelligent’s Chief Revenue Officer; Max is VP Structuring; Alice is an Innovation Intern. Contact Hadrien here for more information.)

The Impact of Microsoft’s Cloud Business Growth on Its Energy Transition Risk

Data Table: Entelligent Return Premium Forecast for Microsoft and Company-Reported Electricity Consumption and Revenue Breakdown